Big earthquake on socials with Twitter and Wechat 🌪☄️

Weekly press review in Tech & Web3 - 18th April 2022 - Issue #44

I’m Sebastien co-founder and CEO of Early Metrics. TechWatchbySeb is a weekly newsletter to provide Tech Investors, Entrepreneurs & Innovators with my selection of news on the Tech and Web3 ecosystems.

To receive the weekly newsletter directly in your mailbox, just click on the button.

Enjoy 😁

Summary for this week

Before starting ☕️

Section 1 - Tech main news:

Musk bid on Twitter

Thoma Bravo is well here

The disaster recovery service which worth $6,2Bn

Section 2 - Web3 main news:

WeChat launching the Web3 revolution

Portugal Banks on the Crypto Ring

$400M to apply for the US Crypto-Bank charter

Total of articles reviewed this week: 31

Before starting ☕️,

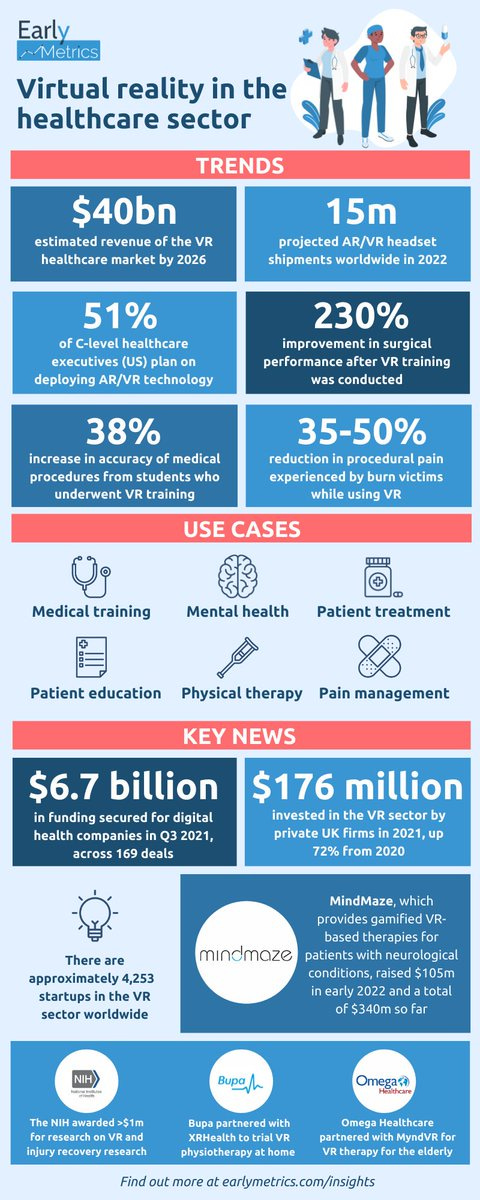

My team Early Metrics has worked on very interesting study around Virtual reality in healthcare. The world has been buzzing around Meta’s plans to create a metaverse, with growing hype surrounding this phenomenon. Much of the conversation focuses on gaming, social media, shopping or artistic endeavours. However, healthcare is a vertical that will have a place in the metaverse and that has been dabbling with virtual reality (VR) already.

The Early Metrics research team has worked on a very insightful infographic to explain the phenomenon.

After this first starter, it is time for the weekly press review selection:

🥇Musk bid on Twitter

Musk 🇺🇸has made an offer to buy Twitter 🇺🇸, a filing with the U.S. Securities and Exchange Commission showed.

The billionaire has said he is willing to pay $54.20 per share to buy 100% of the company. It would be an all-cash offer that values the social network at $43.4 billion.

“I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy,” Elon Musk wrote in an email to Bret Taylor, Twitter’s chairman of the board (and Salesforce co-chief executive). The email was reproduced in today’s SEC filing. “However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.”

“As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder,” he added.

In pre-market trading, Twitter shares traded at $50.97 per share, an 11.97% jump from yesterday’s closing price. Twitter shares have been trading below $54.20 since November 4, 2021. In October, Twitter shares were higher than $60.

Source: Techcrunch

🥈Thoma Bravo is well here

Last week Thoma Bravo 🇺🇸 investment firm was involved on several important operation in the Tech scene, starting with the one presented above:

Buyout firm Thoma Bravo 🇺🇸 approaches Twitter 🇺🇸 with acquisition interest: Buyout firm Thoma Bravo LP has contacted Twitter Inc to express interest in putting together an acquisition offer that would rival Tesla Inc (TSLA.O) Chief Executive Elon Musk's $43 billion bid, people familiar with the matter said on Friday.

Thoma Bravo 🇺🇸 to take identity security company SailPoint 🇺🇸private for $6.9B: SailPoint is an identity and access management provider helping organizations deliver and manage user access from any device. The company was created in 2005.

KKR 🇺🇸 to buy cybersecurity firm Barracuda 🇺🇸 from Thoma Bravo🇺🇸 in deal worth about $4 bln. Barracuda Networks designs, develops, manufactures, distributes, and sells email and web security appliances. It offers cloud-connected solutions that help its customers address security threats, enhance network performance, and protect and store their data. The company was founded in 2003.

Source:

Twitter acquisition: Reuters

Sailpoint: Techcrunch

Barracuda: Reuters

🥉The disaster recovery service which worth $6,2Bn

Datto 🇺🇸, provides backup, recovery, and business continuity solutions to managed service providers worldwide. Its products include ALTO, a business continuity solution designed specifically for small businesses, SIRIS, a family of enterprise business continuity solutions that are available in physical and virtual platforms, Datto NAS, a cloud storage solution, and Backupify, a cloud-to-cloud backup and recovery solution for Software-as-a-Service (SaaS) applications that include Google Apps and Salesforce.

The disaster recovery service, has had an interesting history. It raised a cool $100 million as a startup, including a $75 million investment in 2015, a significant round for that period. Vista Equity purchased the startup in 2017, but that wasn’t the end of its story, not by a long shot. Instead Vista built up the company and took it public in 2020.

Today, the journey took another twist when Kaseya 🇺🇸, a provider of security and management services for internal IT departments and managed servers providers, bought the company for $6.2 billion.

Source: Techcrunch

🥇WeChat launching the Web3 revolution

With over 1.2 billion monthly active users, WeChat🇨🇳 has served as an instrumental resource overseas, and outside the Middle Kingdom. The much anticipated launch of Tencent Digital Yuan Wallet points to the fast-paced development of China’s Central Bank Digital Currency (CBDC).

WeChat Pay has already added digital yuan functionality to 14 other platforms, however, the features pale in comparison to the new Tencent wallet in development. While Tencent’s Digital Yuan Wallet is still in its beta testing stage, unavailable to users, rumor has it that it comes packed with extensive functionalities.

WeChat Pay and AliPay have a large chunk of China’s payments market and it is believed that Tencent and its new wallet could tilt the balance in its favor. The People’s Bank of China (PBoC) launched its digital yuan wallet which garnered over 260 million users in a valiant attempt to snatch some of the market shares from the industry leaders.

Source: beincrypto

🥈Portugal Banks on the Crypto Ring

Bison Bank 🇵🇹, a Portugal-based financial institution, has received a license from the Portuguese central bank (Banco de Portugal) to operate as a virtual asset service provider (VASP), Banco de Portugal announced Thursday.

Bison Bank will create a special business division, Bison Digital Assets, to operate as a virtual asset exchange, according to Portuguese media outlet Sapo.

The division is the first entity in Portugal owned by a bank to be authorized by Banco de Portugal to offer custodian and crypto trading services.

Bison Bank provides wealth management, depositary and investment banking services to individuals and institutional clients, according to its website. It is owned by a Hong Kong-based Chinese private capital group.

In March, Banco do Portugal granted the first full all-categories VASP license to Utrust, a Portugal-based on-chain crypto payments firm.

In June, it licensed two cryptocurrency exchanges, Criptoloja and Mind The Coin, to operate as VASPs. The bank also granted a crypto exchange license to Luso Digital Assets.

Source: coindesk

🥉$400M to apply for the US Crypto-Bank charter

Circle 🇺🇸has confirmed that it is on course to securing approval for a bank charter and is already discussing with regulators.

Circle provides an online platform that enables users to send money quickly and easily. Circle uses blockchain technology with Circle Pay to ease and improve how users send money. Circle expands its services with a crypto-currency investment product with Circle Invest, enabling anyone to buy and sell crypto assets. It provides crypto-coins and offer OTC trading services via Circle Trade. Its crypto-trading desk provides one of the largest global liquidity pools for digital asset trading and averages $2 billion in monthly volume.

Circle was founded in 2003 and has raised to $1.1Bn with important investors such as Blackrock.

Source: Coinspeaker

Connecting the community #TechWatchbySeb 😁

Question of the week

What do you think of Elon’s intention to acquire Twitter? 😎😎

Next week, I’ll share you the result of the survey and my views.

My best tweet last week 😎😎

Sharing good vibes 😎

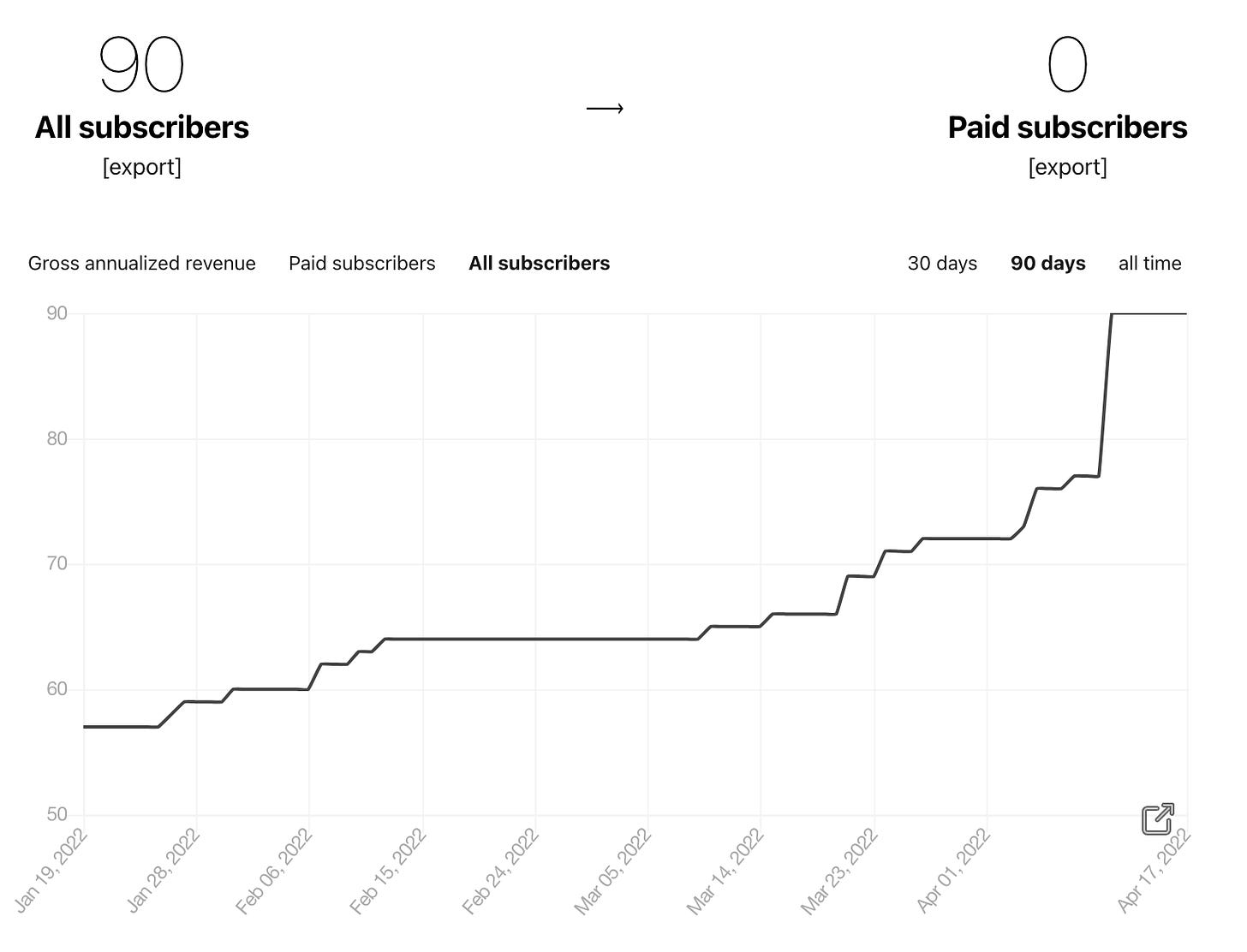

Thanks guys for reading this newsletter every week. We are now 90 readers!

Feel free to share to keep expanding the community

👍 That’s it for this week, wishing you a great week ahead, and feel free to share if you like 😁